Advantages And Disadvantages Of Sst In Malaysia

Disadvantages of gst besides the above listed many advantages the gst structure is also criticized for many reasons so let s discuss disadvantages of gst which are listed below.

Advantages and disadvantages of sst in malaysia. Advantages and disadvantages of sst and gst in malaysia. This new tax regime has caused some businesses uncertainty as well as money. Sst will cause the government s tax revenue to drop which is an estimation of about rm25 billion. Gst search number can be verified easily online.

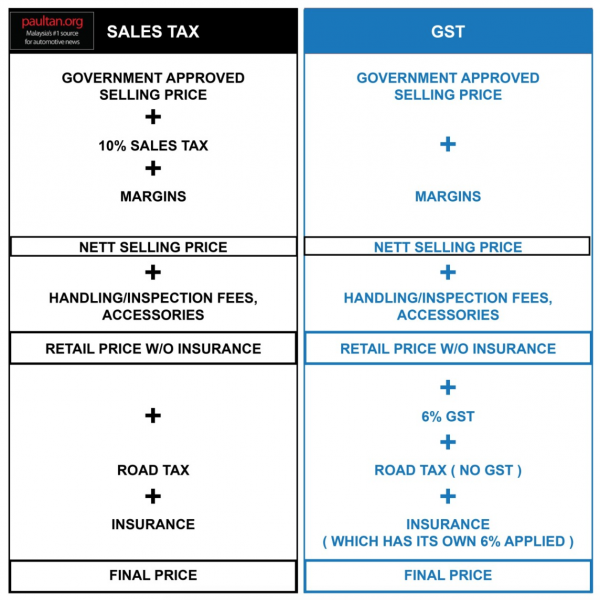

Gstin can be verified through the gst portal very easily. He said an example is the price of a rm100 000 property which would cost rm106 000 with the addition of gst for buyers but the 10 sst does not apply to the rm100 000 price tag. All you need is a smartphone with an internet connection and the details you want to verify. This was announced by finance minister lim guan eng on 16 july 2018 who informed that the bill on sst will be passed in parliament sometime in august.

Follow malaysia s budget 2020 live updates here. The reintroduction of the sales and services tax sst will see its rate set at 10 for sales and 6 for services. It is a single stage tax imposed on factories or importer at 10. Therefore the wholesellers and retailers do not need to pay this tax no need to prepare quarterly tax submission as required under gst.

The advantages disadvantages of gst in malaysia. 1 the gst structure has been marketed well to portray it as a simple concept but in reality the understanding is complicated and distortionary to fully exploit the. In general sst will increase prices of certain items as its only imposed on selected items while gst is imposed on every goods and sales. Malaysia s decision to revert to the sales and service tax sst from the goods and services tax gst will result in a higher disposable income due to relatively lower prices it will incur in.

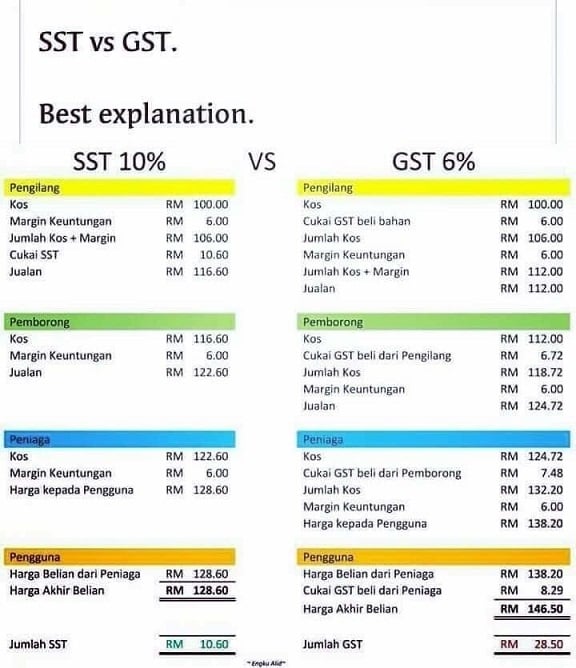

Disadvantages of sales and services tax. The advantages for sst are. Figure 3 below shows the direct comparison between the two types of taxes. The gst is basically a form of taxation system imposed by the government where there is a single tax in the economy that is placed upon goods and services offered.

There are both advantages and disadvantages for gst and sst. Sst s criticism and disadvantages are as follows while most countries are moving to gst malaysia reverted back to sst even though many believe it to be a less progressive form of tax.