Sales Tax Exemption Malaysia 2018

Under section 14 of sales tax act 2018 voluntary registration is allowable to.

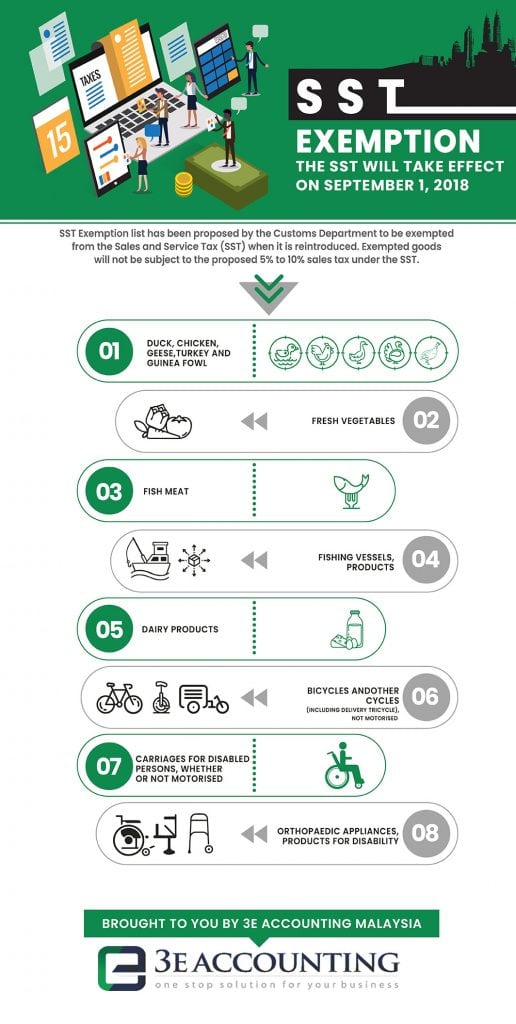

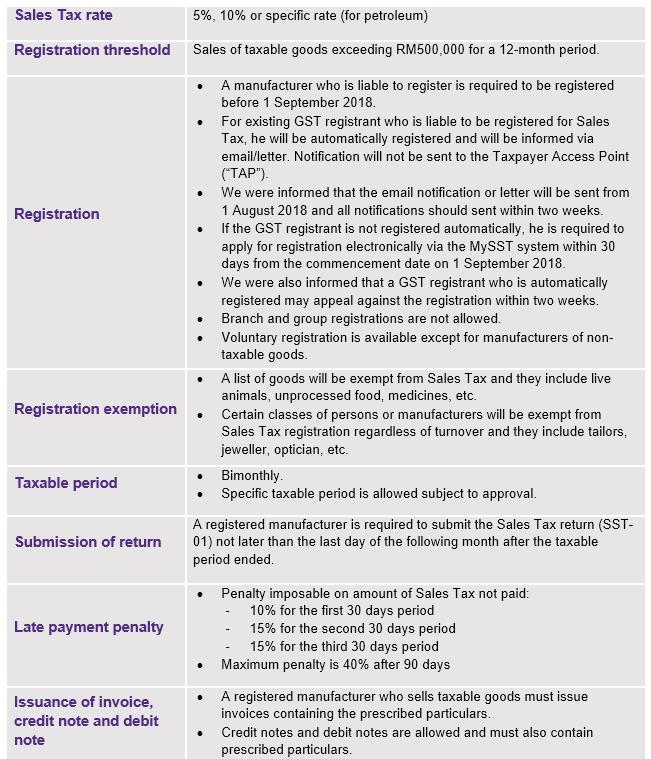

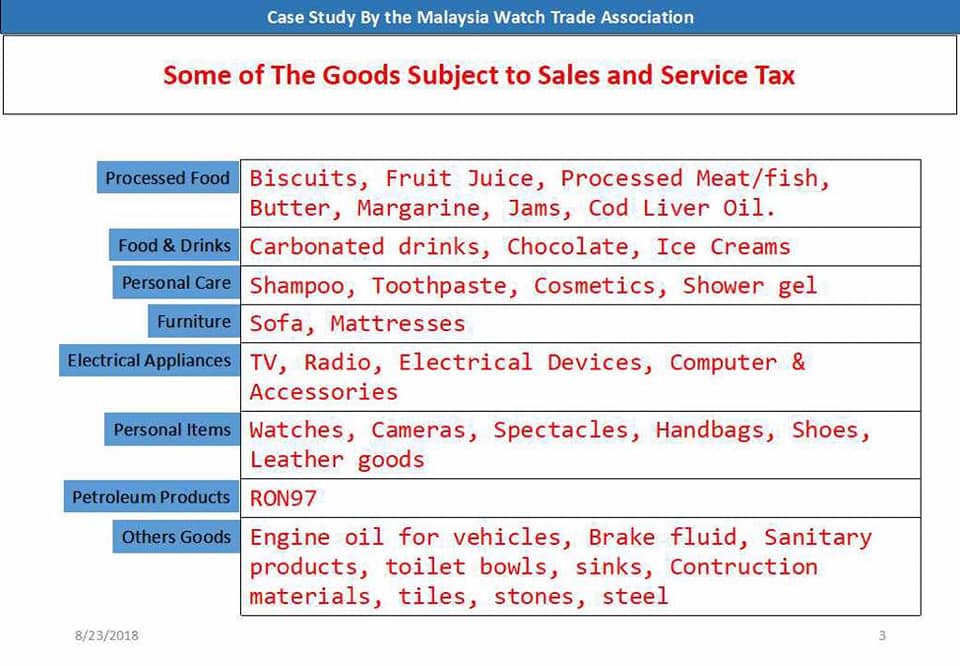

Sales tax exemption malaysia 2018. Registered manufacturer exemption of tax on the acquisition of raw materials components packaging to be used in manufacturing of taxable foods sources. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. The sales tax exemption is fundamentally similar to the tax holiday that malaysians enjoyed between june to august 2018 during which the goods and service tax gst was zero rated from all vehicle prices. Effective from 1 september 2018 sales tax act 2018 and the service tax act 2018 together with its respective subsidiary legislations are introduced to replace the goods and service gst act 2014.

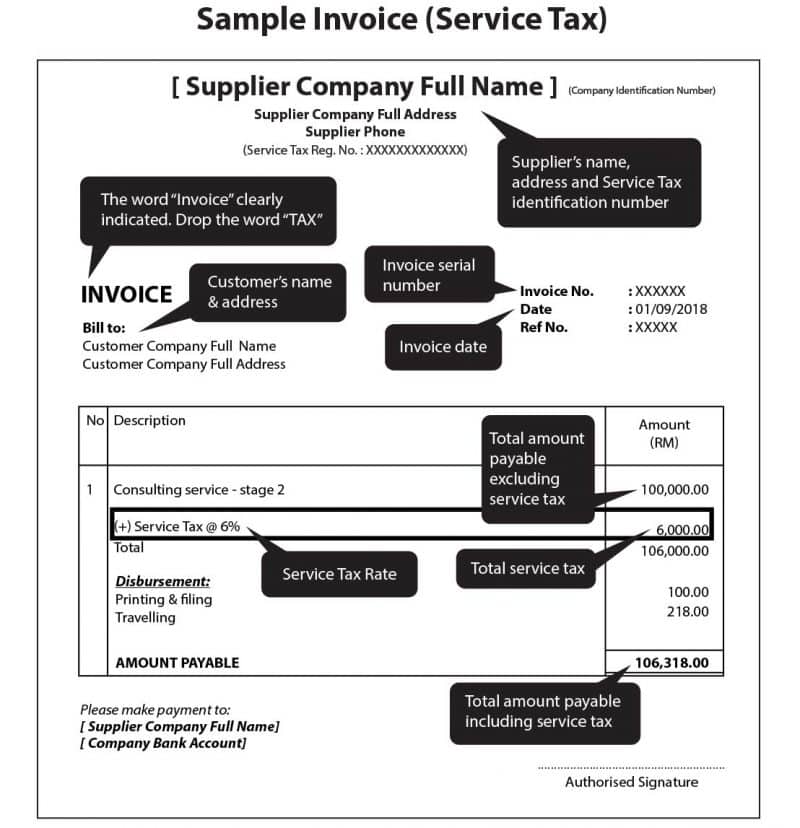

What is sales tax. Sales tax is a single stage tax charged and levied. Malaysia sales service tax. Amendment 1 2019 sales tax determination of sale value of taxable goods regulations 2018.

What are the goods subject to sales tax. The automotive industry has lauded the government s move to fully exempt sales tax for locally assembled cars and halved the sales tax for imported cars to 5 from 10 from june 15 to dec 31 2020. Malaysia sales tax 2018. On taxable goods imported into malaysia.

The move was announced by prime minister tan sri muhyiddin yassin in his address to the nation today on the rm35bil short term economic recovery plan. Following the announcement of the re introduction of sales and services tax sst that will kick start on 1 september 2018 the royal malaysian customs department rmcd has recently announced the implementation framework of sst as well as a detailed faqs to arm malaysians with sufficient knowledge of the new tax regime before sst commence. Under the sales tax act 2018 sales tax is charged and levied on imported and. Manufacturer of taxable goods and having the annual total sales value below the threshold of rm500 00 within the period of 12 months.

Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. The move was made back then in anticipation of the re implementation of the sales and services tax sst. Sst treatment in designated area and special area. On taxable goods manufactured in malaysia by a taxable person and sold by him including used or disposed off.

This will result in cheaper. Proposed sales tax. Malaysia sales tax 2018. Amendment 1 2019 sales tax compounding of offences regulations 2018.

Malaysia service tax 2018. Frequently asked questions faq sales tax 2018 sales tax 1.